19.12.2024

Central Bank Worship on the Wane: Why the ECB struggles to revive “animal spirits”

Tribune

26 février 2016

In the United States, the Federal Reserve, following the bankruptcy of Lehman Brothers, embarked on an ultra-expansionary policy mix—most notably with zero interest rates and three successive rounds of quantitative easing—which helped revive lending and lower the dollar’s exchange rate for some time. Throughout its quantitative easing programmes, the Fed added $3.7 trillion to its holdings, pouring as much liquidity into the markets. In contrast with its limited effect on the real economy, this policy created the conditions for a spectacular and somewhat problematical surge in asset prices, well beyond a mere bounce-back. In so doing, it also deeply destabilised financial flows to emerging markets.

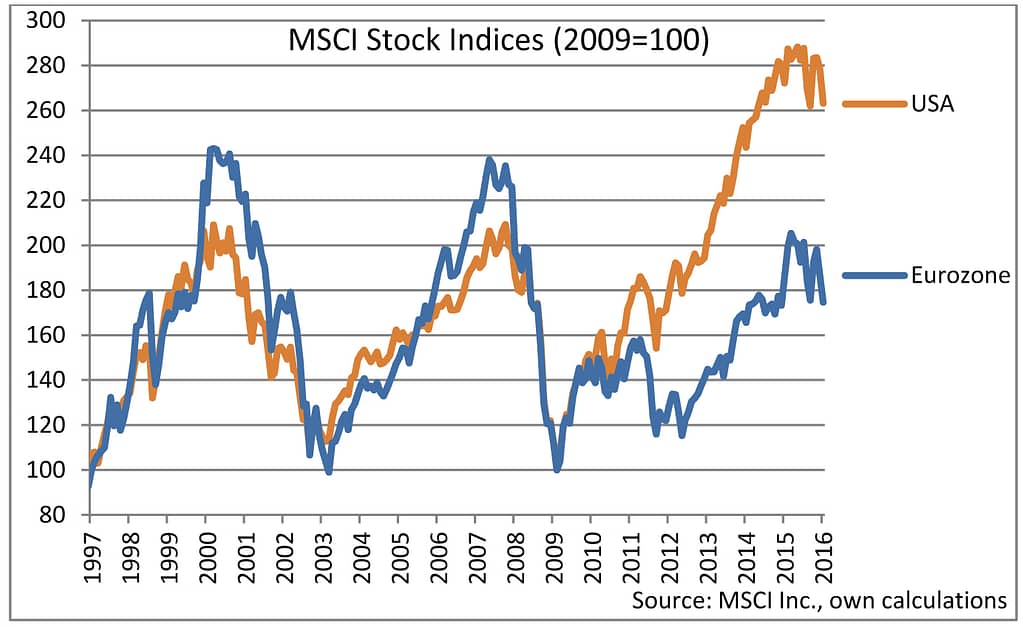

In stark contrast with the Fed, the ECB was slow to lower its key interest rates (and even ill-advisedly hiked them in 2011) and waited until the beginning of 2015 to set up a bond purchase programme. As such it followed the Fed’s path belatedly but with a convert’s zeal. It turns out that its expansionary policy, which is aimed at tackling deflationary trends, is still far from yielding the awaited results—which is hardly surprising if the real drivers of aggregate demand are taken into consideration. In addition, Mario Draghi’s pledge to not only do ”what it takes” but, it seems, “ever more” does not seem to provide that much support to financial markets as they are beleaguered by the Eurozone’s bleak economic reality. The ECB’s QE programme has come at a time when US equity markets were grinding to a halt, following the discontinuation of the Fed’s own purchase programme, which had propelled them to a level 2.8 times as high as their 2009 low and 37 percent higher than their 2007 peak.

It is certainly not an end in itself for monetary policy to stimulate financial markets. Nonetheless, faced with the permanent threat stemming from the bursting of bubbles which they have helped inflate, central banks are trapped in a vicious circle. The contrasting market reaction to QE in the Eurozone and in the US points to substantial differences. Not only have these programmes been introduced at different stages of the « recovery », but the underlying financial situation differs markedly too. As early as 2008, the US authorities set up the Troubled Asset Relief Program (TARP), which aimed to rid financial institutions of the toxic assets that undermined their solvability. This measure was controversial, as it encouraged the main actors of the bubble to back away from their responsibilities. Meanwhile it helped prevent a collapse of the financial system and restore confidence in the interbank market. The operation has even proved profitable for the US Treasury, once its $442 billion worth of related assets were sold back over the course of the recovery. The Fed’s QE programme therefore took place in a context where banks were stabilising and the economy was recovering, albeit modestly.

Such programmes are the responsibility of a sovereign state, not only of a central bank—despite the latter’s utmost responsibility as the lender of last resort. The state is in charge of preventing a collapse, even if this involves taking the risk of exceptional and controversial measures that are beyond the scope of monetary policy. The Fed’s purchasing programme faced this reality as the sums that were injected, as large as they were, essentially remained trapped within the financial markets and had little impact on the real economy. The bolder idea of « helicopter money »[1] actually appealed to Ben Bernanke as he appeared willing to fund a fiscal stimulus through the “printing press”, probably under the guise of a permanent purchase programme. Such a plan, which would have implied a framework of budgetary coordination with the Treasury, was excluded by the balance of power in Congress although it would have proved financially less damaging and economically more meaningful than QE. To put it simply, “helicopter money” aimed at the real economy, in a context of very low inflation, might actually be more in line with conservative standards than abstract quantitative easing. It is of little surprise that Milton Friedman advocated such an approach as early as 1948, alongside a proposal for the adoption of a 100 percent reserve system [2].

The Eurozone is an economy without a state—or with nineteen unequal governments to be more accurate. Consequently the area’s leaders were unable to follow suit with the “second best” options taken by the US authorities. Not only did the ECB restrict itself to a very timid monetary response in the first place but, much more importantly, the political authorities shied away from the structural financial measures that were needed to reactivate the banking system. With regard to the monetary response, the opposing monetary cultures among Eurozone countries, particularly between Germany and France, precluded any substantial move under Jean-Claude Trichet’s chairmanship. The volubility and communicational genius of his successor, Mario Draghi, certainly helped to avoid a messy break-up of the currency union in 2012 but his activism now seems to face an insurmountable obstacle. Beyond the mere issue of monetary policy, Eurozone leaders are still not in a position to devise a viable economic and financial architecture. More than a mere technical mistake, the wobbly political balance among the union’s member states is the root cause of this inextricable situation.

Against this background, the sword of Damocles is still hanging over European banks. The ECB’s negative deposit rate is often blamed for undermining the profitability of the banks that still reward deposits with positive interest rates. Hybrid debt securities, such as contingent convertible bonds or « Coco bonds », which are convertible into shares in case of trouble (so as to boost the bank’s capital), have also been mentioned as a source of weakness, as these securities have been issued in excess by the like of Deutsche Bank. Yet, the risk that weighs on European banks far exceeds these aspects alone. The permanent invocation of the “banking union” fails to hide the fact that it simply does not exist beyond a mere system of supervision and a very modest resolution scheme for failing banks. A common insurance for bank deposits remains illusory or even taboo, just like the constitution of a joint government backstop to address failing banks, which should work as an insurance mechanism and break the feedback loop between the banking sector and state finances in a given country.

With regard to the EU’s new bank resolution and recovery directive (BRRD)—which includes the “bail-in” of bondholders as well as large depositors of a failing bank (to the tune of 8pc of the bank’s liabilities) before any taxpayer money is disbursed—it addresses a highly legitimate concern. Its purpose is to prevent taxpayer money from being used to pour astronomical sums into failing banks that took excessive risks. But are these provisions credible and viable under the current circumstances? This system might make it possible to handle individual cases of non-systemic banks. This is to forget the vast interconnections between financial institutions, which generally follow the same trends and resort to the same practices, especially in times of booms and busts. When a system of irresponsibility has thrived for decades with the blessing of governments—whose debts were considered to be « risk-free »—it is particularly perilous to decide overnight, in a context of crisis and mass unemployment, the absolute accountability of creditors and large depositors alike. In order to achieve this crucial goal, a dynamic of genuine financial stabilisation and economic recovery should have been previously (or at least simultaneously) initiated. The Eurozone followed the opposite path, with pro-cyclical measures. In addition, the supervisors pushed the banks to recapitalise to levels which might seem elevated now but would not even protect them sufficiently in the likely event of a new financial crisis.

Yet fixing the banking sector is even more crucial for the Eurozone than for the United States. Mario Draghi stresses his desire to develop bond funding for the corporate sector, in order to make companies less dependent on bank lending. It should be borne in mind that 93% of Eurozone companies have less than 10 employees (compared to about a half in the United States). These are very much unlikely to access the bond market, if not through dubious small loans securitisation programmes. Furthermore, the benefits such a turning point would bring about in terms of long-term financial stability are highly doubtful. Emulating the financial model of the US in this matter is illusory. As bank lending is structurally more important in Europe than in the US, it is even more essential to put European banks back on track to finance the economy. Far from such a goal, the financial reforms pursued by the Eurozone can be seen as the more or less unconscious path towards a system of widespread default. Even though these reforms have legitimate goals and some technical consistency, the overall system makes little economic sense. It bears the tangible risk of a crisis of great magnitude that would eventually see the states, in violation of the principles advocated today, fly to the rescue of the banking sector once again and sacrifice their finances.

Central banks seem to have become the “slaves of the markets”, as the Economist recently put it , but it is the governments which have given them the kiss of death. Trying to make up for policymakers’ inability to restore a sustainable system and to ward off the threat of financial collapse, central banks have fed the illusion of solvency through a succession of asset bubbles for more than two decades. Despite the prestige of this increasingly political role, which goes beyond the mere notion of independence, the oscillatory nature of this system undermines their credibility and hinders their capacity to act strategically. The ineffectiveness of the ECB’s measures, in particular, mirrors the political fault line that irremediably divides Europe.

[1]See « Lunch with the FT: Ben Bernanke » par Martin Wolf, 23 October 2015. “I think a combination of tax cuts and quantitative easing is very close to being the same thing [helicopter money]”.

[2] Milton Friedman, A Monetary and Fiscal Framework for Economic Stability, American Economic Review 38, pp. 245-264, June 1948